Abstract

Over the past several years, tokenization has moved from theory to inevitability. Major incumbents—including the NYSE and Nasdaq—have announced plans to tokenize securities and modernize post-trade infrastructure. Yet despite these advances, today’s market structure remains fundamentally incompatible with real-time settlement, continuous liquidity, and programmable ownership.

This article argues that meaningful progress in tokenized securities requires more than digitizing existing assets—it requires a clean-slate market model. We explain why the legacy exchange-and-clearing framework cannot support real-time settlement, why incumbent tokenization efforts remain constrained by Reg NMS and legacy clearing rails, and how Ohanae is building a complementary, off-exchange market designed natively for instant settlement, direct investor ownership, and continuous capital formation.

Together, these developments mark the emergence of a new institutional stack for public securities—one that does not replace NYSE or Nasdaq, but extends the market into a future they structurally cannot reach alone.

1. The Structural Limits of Today’s Markets

Modern securities markets were not designed for speed—they were designed for scale, reconciliation, and risk containment.

The current U.S. market structure relies on:

- Intermediated ownership

- Batch netting

- Central clearing

- Deferred settlement

Even with the move from T+2 to T+1, the system still depends on:

- Intraday credit exposure

- Margin requirements

- Clearinghouse risk mutualization

- End-of-day reconciliation

Real-time settlement is not merely unsupported by this architecture—it is structurally incompatible with it.

You cannot have:

- Instant settlement

- Continuous trading

- Atomic delivery-versus-payment

…inside a framework built around delayed netting and omnibus ownership.

This is not a technology problem. It is a market design problem.

2. Tokenization Without Market Reform Is Not Transformation

Recognizing these constraints, incumbents have turned to tokenization.

NYSE and Nasdaq have both announced initiatives to:

- Create digital representations of securities

- Extend trading hours

- Explore on-chain settlement and tokenized collateral

- Maintain fungibility with existing listed shares

These efforts are important—and inevitable.

But they share a common characteristic: the market structure does not change.

Tokenized shares remain:

- Reg NMS securities

- Subject to NBBO and Rule 611

- Cleared through existing clearing agencies

- Settled via legacy custodial frameworks

In effect, these initiatives digitize the wrapper while preserving the plumbing.

As a result:

- Settlement cannot be truly real-time

- Liquidity remains fragmented

- Capital formation remains episodic

- Ownership remains intermediated

Tokenization, in this model, is evolutionary—not transformational.

3. Two Paths Are Now Emerging

Recent regulatory and industry developments—including DTC Tokenization Services, exchange-led digital platforms, and ATS-based tokenization initiatives—have clarified that tokenized securities are splitting into two distinct paths:

Path One: Reg NMS–Anchored Tokenization

- Digital representations of listed securities

- Exchange-based trading

- Legacy clearing and settlement

- Incremental efficiency gains

This is the path NYSE and Nasdaq are pursuing.

Path Two: Clean-Slate Tokenized Markets

- Native digital securities

- Direct investor ownership

- Cash-only, atomic settlement

- Principal liquidity

- Continuous issuance and trading

This second path cannot exist inside Reg NMS.

And that is precisely where Ohanae operates.

4. Ohanae’s Clean-Slate Market Model

Ohanae is building a regulated, off-exchange market infrastructure designed from day one for tokenized securities.

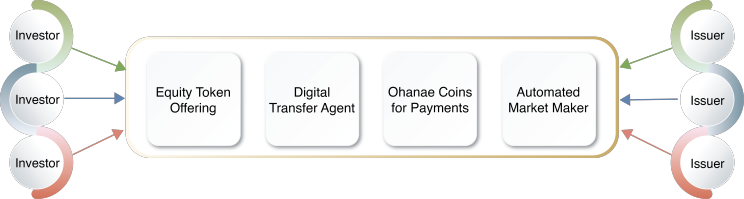

Ohanae - Custodial Tokenized Securities Platform

At its core, Ohanae combines:

- A Special Purpose Broker-Dealer (SPBD)

- Direct private-key custody

- A native stable settlement token (OUSD)

- Dealer-principal liquidity

- A digital transfer agent

- A public-permissioned blockchain (Ohanae Chain)

This enables:

- Instant, cash-only settlement

- 24×7 secondary trading

- Continuous capital formation

- Programmable corporate actions

- Direct beneficial ownership

Crucially, Ohanae does not rely on:

- Clearinghouses

- Intermarket routing

- Batch reconciliation

- Third-party custodial wallets

The result is a market where settlement, custody, and ownership are natively integrated, not layered on top of legacy systems.

5. A Familiar Analogy: Issuer-Sponsored ADRs

The cleanest way to understand Ohanae’s approach to existing public securities is through a familiar construct: issuer-sponsored ADRs.

Like ADRs:

- Ohanae-listed tokens represent a distinct security class

- They have their own settlement rails

- They trade in a separate market

- They carry the same economic and governance rights as the underlying shares

But unlike ADRs:

- Settlement is instant, not T+2

- Ownership is on-chain, not book-entry

- Liquidity is continuous, not session-bound

- Corporate actions are programmable, not manual

This structure allows Ohanae to:

- Remain outside Reg NMS constraints

- Avoid NBBO and order protection rules

- Still reference public market prices for transparency

- Maintain full economic parity with listed shares

It is not regulatory arbitrage. It is market pluralism.

6. Complementing NYSE and Nasdaq—Not Replacing Them

Ohanae is not attempting to replace incumbent exchanges.

Instead:

- NYSE and Nasdaq remain the centers of price discovery for listed equities

- Ohanae becomes the venue for real-time settlement, continuous liquidity, and token-native issuance

This is why the positioning matters:

NYSE. Nasdaq. Now Ohanae.

Together, they form a layered market:

- Exchanges for discovery and scale

- Ohanae for immediacy, programmability, and ownership innovation

This is how markets evolve—by addition, not displacement.

7. Why This Matters Now

Tokenization is no longer speculative. Real-time settlement is no longer theoretical. Regulatory pathways are beginning to open.

What has been missing is a market structure designed for the destination, not the past.

Ohanae represents that missing layer.

Not crypto. Not TradFi. But the next generation of public securities infrastructure.

Conclusion

Markets do not change because technology improves. They change because structure evolves.

NYSE and Nasdaq are modernizing. But Ohanae is re-architecting.

And that distinction makes all the difference.

Reference: The Coming of Age of Tokenized Securities Markets: Why Ohanae Is Uniquely Positioned

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to crypto asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.