Abstract

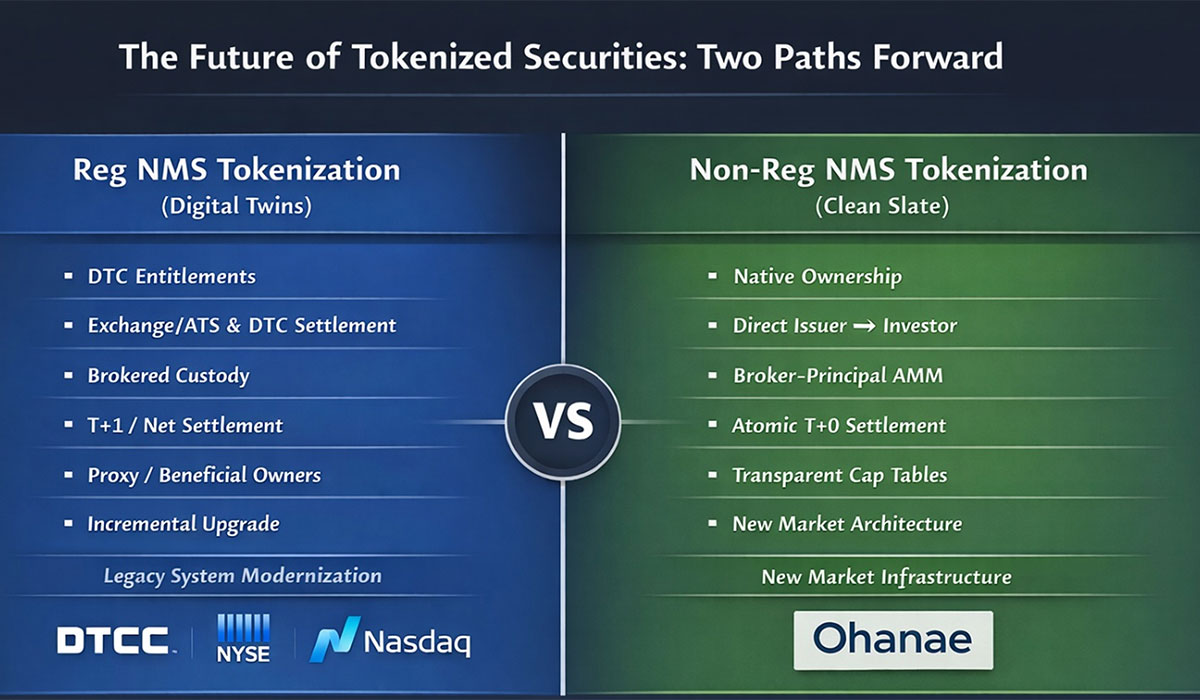

Tokenized securities are evolving along two distinct paths. The first, Reg NMS tokenization, modernizes existing market infrastructure using the SEC-sanctioned digital twin model, preserving DTC custody and net settlement while improving transparency and reconciliation. The second, non-Reg NMS tokenization, exemplified by Ohanae, builds a clean-slate market with native on-chain ownership, atomic T+0 settlement, and broker-dealer–facilitated AMM liquidity. This approach enables 24×7 secondary trading, regulated capital formation, and interest-bearing tokenized money market funds. The article explores these parallel pathways, highlighting why Ohanae’s regulated, custodial platform represents the next-generation market infrastructure.

Introduction

Tokenization is no longer theoretical. It is happening—now.

But what’s becoming increasingly clear is that tokenized securities are not converging toward a single market model. Instead, they are splitting into two distinct regulatory and architectural paths, each optimized for very different outcomes.

Understanding this divergence is critical for issuers, investors, regulators, and financial institutions alike.

Path One: Reg NMS Tokenization — The Digital Twin Model

The first path modernizes the existing U.S. securities market structure.

This approach was formally validated by the SEC through its No-Action Letter related to The Depository Trust Company’s (DTC) development of DTCC Tokenization Services. The relief permits the creation of tokenized representations (“digital twins”) of Reg NMS securities, provided that:

- Legal ownership remains at DTC (Cede & Co.)

- Settlement finality continues through NSCC/DTC

- Blockchain is used for recordkeeping, reconciliation, and messaging

- No changes are made to custody, clearing, or broker-dealer obligations

In short, the blockchain token is not the security.

It is a representation of an entitlement to a position that still lives inside the traditional plumbing.

What This Model Does Well

- Preserves regulatory continuity

- Enables faster reconciliation and transparency

- Allows institutions to experiment without re-architecting the system

- Scales immediately across trillions of dollars in listed securities

What It Does Not Do

- Eliminate intermediaries

- Enable atomic settlement

- Provide direct issuer–investor ownership

- Unlock new asset classes or market structures

This is modernization, not reinvention.

Path Two: Non-Reg NMS Tokenization — The Clean-Slate Market

The second path does not attempt to modernize the existing system.

It builds a new one where the old rules no longer fit.

This is the path Ohanae has chosen.

Non-Reg NMS tokenization focuses on:

- Securities issued natively on-chain

- Outside national exchanges and the NMS

- Outside DTC

- With direct issuer → investor ownership

- Under existing exemptions such as S-1, Reg A, Reg D, and Reg S

Here, blockchain is not a mirror.

It is the system of record.

Settlement is atomic (T+0).

Transfers are broker-dealer controlled.

Compliance features such as rollback, forced transfer, and court-order enforcement are built directly into the architecture.

This model is not constrained by legacy clearing, netting, or settlement cycles—because those mechanisms were designed for a different era.

Why This Is Not “OTC 2.0”

A common misconception is that non-Reg NMS markets are simply an extension of OTC trading.

They are not.

Many OTC securities still settle at DTC.

Non-Reg NMS tokenized securities do not.

The real distinction is not where securities trade—but how they settle and who owns them.

That difference is foundational.

Why Ohanae Uses an AMM — and Why Liquidity Is Multi-Dealer

Ohanae operates a dealer-principal automated market maker (AMM) for tokenized securities.

This is intentional.

Under U.S. securities law:

- Only broker-dealers may effect securities transactions

- Peer-to-peer, irreversible settlement is not permitted

- Customer protection rules (Rule 15c3-3) require strict cash controls

The AMM model allows:

- Continuous, 24×7 liquidity

- Deterministic pricing and settlement

- Full broker-dealer compliance

- Atomic exchange of securities and tokenized cash

To scale liquidity responsibly, Ohanae is onboarding additional broker-dealers as passive liquidity providers (available in 2027).

This creates:

- Redundant market depth

- Competitive pricing

- Risk dispersion

- Institutional resilience

Liquidity is not crowdsourced.

It is regulated, capitalized, and accountable.

Why Tokenized Money Market Funds Matter

Ohanae’s settlement token (OUSD) is not yield-bearing by design.

That is deliberate.

Under customer protection rules, settlement cash must:

- Be fully backed

- Be redeemable at par

- Reside in protected reserve structures

Yield belongs in a separate product layer.

This is why tokenized Money Market Funds (MMFs) are essential.

Think of it this way:

- OUSD = checking account (settlement, safety, immediacy)

- Tokenized MMF = savings account (yield, capital preservation)

By offering tokenized MMFs with native on-chain cap tables, Ohanae enables:

- Interest-bearing cash alternatives

- Seamless movement between yield and liquidity

- A compliant on-chain cash stack

This is not DeFi yield.

It is regulated yield.

Why Two Paths Will Coexist

The SEC’s no-action relief did not eliminate the need for clean-slate markets.

It confirmed that one size does not fit all.

- Reg NMS tokenization improves efficiency within the existing system

- Non-Reg NMS tokenization enables markets the existing system cannot support

The future is not either/or.

It is parallel evolution.

Our Positioning

NYSE. Nasdaq. Now, Ohanae.

Ohanae is a regulated, custodial platform for tokenized securities with instant settlement using tokenized cash — outside traditional exchanges.

We provide:

- 24×7 liquidity through direct secondary trading

- Capital formation via equity crowdfunding

- Native issuance, custody, trading, and settlement

- A compliant alternative market structure for the next generation of securities

The old system is being modernized.

A new one is being built.

Both matter

But only one enables what comes next.

The future of tokenized securities is not a single road. It is two paths forward.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to crypto asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.