Abstract:

Tokenized securities are rapidly evolving from experimental instruments into fully regulated investment vehicles. In Part II of our series, we analyze NYSE and Nasdaq tokenization plans, compare them with platforms like Securitize and Figure OPEN, and highlight Ohanae’s strategic positioning as a first-mover in compliant, off-exchange tokenized securities. This blog explores how Ohanae is redefining public securities, enabling end-to-end investor custody, liquidity, and capital formation, while offering a complementary market to traditional exchanges.

Read Part I here: The Coming of Age of Tokenized Markets: Why a Clean-Slate Market Structure Is Finally Possible

Tokenization Efforts by Traditional Exchanges

NYSE:

The NYSE, through its parent Intercontinental Exchange (ICE), has announced plans to develop a blockchain-based trading platform for tokenized securities that supports 24×7 trading and on-chain settlement with near-instant finality. The design integrates NYSE's existing matching engine with blockchain post-trade systems and stablecoin funding, while preserving regulated access and traditional shareholder rights.

Nasdaq:

Nasdaq is collaborating with DTC Tokenization Services to offer tokenized digital twins of securities. The initiative is ATS-based, intermediating buy/sell orders rather than holding principal liquidity. Settlement occurs via traditional custodians, not natively on-chain. This approach primarily targets recordkeeping and secondary market efficiency for existing securities rather than creating a fully independent tokenized market.

ATS-Based Platforms: Securitize and Figure OPEN

Securitize:

- Operates as an SEC-registered broker-dealer, transfer agent, and ATS.

- Supports token issuance, compliance controls, and secondary trading, including planned tokenized public equities.

- Enables near real-time on-chain settlement for tokenized shares, with optional on-chain custody.

- Liquidity relies on participant orders and market makers, not principal inventory.

- Limitations: Cannot internalize liquidity in a dealer-principal model; T+0 settlement applies only to on-chain tokenized assets, not legacy exchange shares.

Figure OPEN:

- Provides custody via BitGo, with ATS-based order routing and limited automated market mechanisms outside traditional trading hours.

- Does not operate as a principal dealer or provide full T+0 settlement; cannot replace legacy exchange mechanics.

Ohanae: A Clean-Slate, Dealer-Principal Approach

Ohanae's market design is fundamentally different:

- New tokenized classes (e.g. Class B shares) for public issuers, complementing Class A shares on NYSE/Nasdaq.

- Instant T+0 settlement via OUSD, a proprietary stable settlement token tied to customer protection under Rule 15c3-3.

- Hybrid principal/AMM liquidity model: Ohanae provides principal-led liquidity with AMM-inspired mechanisms to enable 24×7 trading and execution reliability even in thinly traded assets.

- Capital formation engine: Ohanae supports issuance and equity crowdfunding across public, semi-public (Reg A), private (Reg D), investment contract and ancillary assets, enabling compliant and integrated capital raising.

- End-to-end investor relationship: Ohanae owns the customer account, offering regulated custody, direct ownership, and capital-efficient settlement.

- Programmable securities features: Corporate actions, fractional ownership, and dividend distribution are automated and on-chain.

Strategic Positioning: "NYSE, Nasdaq. Now, Ohanae."

Ohanae creates a complementary market for tokenized shares that adds speed, liquidity, capital formation, and programmability, without replacing the NYSE or Nasdaq core mechanics.

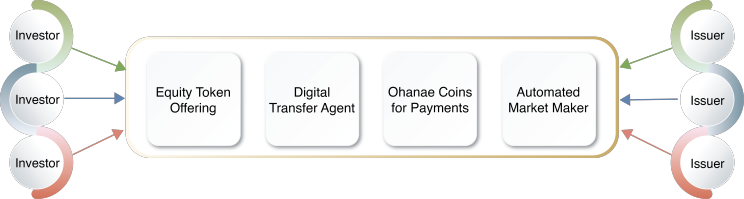

Ohanae - Custodial Tokenized Securities Platform

Understanding Ohanae’s Hybrid Liquidity Architecture

The hybrid liquidity model combines dealer-principal execution with automated market mechanisms:

- Dealer-Principal Liquidity: Ohanae Securities acts as a counterparty for trades, maintaining inventory of tokenized shares to support execution.

- AMM-Inspired Mechanisms: Automated mechanisms ensuring continuous liquidity without relying on market participants.

- Risk Management: Like traditional market makers, Ohanae monitors inventory and pricing to mitigate exposure to illiquid or low-demand assets. The principal model allows controlled balance-sheet commitment, while AMM logic ensures orderly execution and fair pricing.

Capital Formation: The Critical Component

- Unlike legacy exchanges or ATS platforms, Ohanae provides a full-cycle capital formation engine:

- Public Issuers: Tokenized Class B shares complement Reg NMS Class A shares, enabling off-exchange liquidity.

- Semi-Public (Reg A) and Private (Reg D) Securities: Fully compliant issuance with automated onboarding and KYC/AML controls.

- Investment Contract Assets and Ancillary Assets: Programmable securities and tokenized financial instruments allow new capital-raising opportunities.

- Integrated Compliance: Custody, settlement, and corporate action processing are embedded in the tokenized security design, reducing operational complexity and risk.

NBBO Price Referencing: Building Investor Confidence

Ohanae can subscribe to CTA/UTP feeds for NYSE/Nasdaq, giving access to NBBO (National Best Bid and Offer) and last-sale prices:

- Investors can gauge fair value for tokenized Class B shares.

- Provides confidence without becoming a full exchange member.

- Supports regulated arbitrage mechanisms to ensure price alignment with legacy markets.

This capability enhances credibility and helps investors trust off-exchange tokenized securities while maintaining independence from Reg NMS rules.

Why Ohanae Can Lead

- Regulatory First-Mover Advantage: Positioned to secure approval as a compliant off-exchange tokenized securities platform, setting the stage for dealer-principal trading and settlement.

- End-to-End Settlement & Liquidity: Continuous, atomic T+0 settlement with principal inventory plus AMM liquidity ensures reliability.

- Capital Formation Engine: Supports issuance across all asset classes—public, semi-public, private, investment contract assets, and ancillary assets.

- Investor Custody and Relationship: Full control of accounts, custody, and compliance reduces friction and enhances investor trust.

- Programmable Ownership: Corporate actions, fractional ownership, and automated distributions enhance efficiency and unlock new market models.

Key Takeaways

- Legacy Exchanges (NYSE/Nasdaq/DTC): Deep liquidity, robust price discovery, trusted settlement. Off-exchange trading of Reg NMS securities provides no immediate advantage for investors.

- ATS-Based Platforms (Securitize, Figure OPEN): Offer token issuance, private market access, and some secondary trading, but cannot replicate dealer-principal liquidity, T+0 settlement, or integrated capital formation.

- Ohanae: Combines off-exchange tokenized public securities, continuous liquidity, investor custody, capital formation, and programmable features—creating a complementary market that adds value without replacing legacy exchanges.

Implication: Investors may adopt Ohanae for speed, flexibility, liquidity, capital formation, and innovative features, not because it replaces NYSE/Nasdaq, but because it creates a new, complementary tokenized market.

Read Part I here: The Coming of Age of Tokenized Markets: Why a Clean-Slate Market Structure Is Finally Possible

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to crypto asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.