Abstract

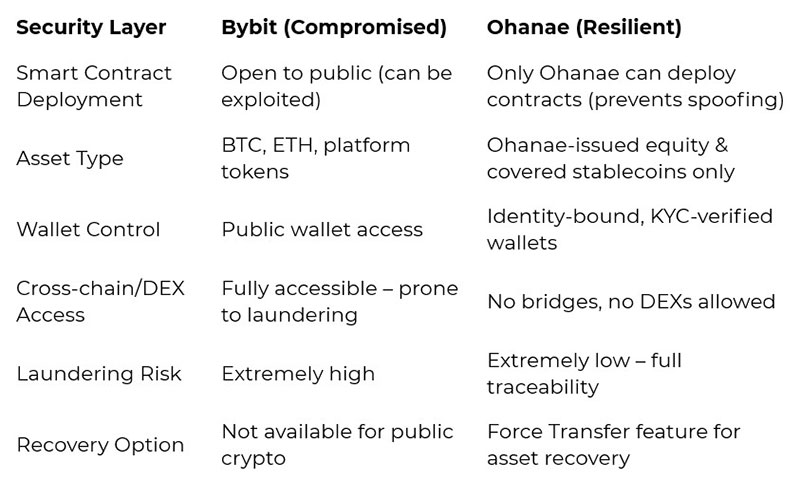

Just like corporate shares can be recovered if stolen, the same must apply to tokenized securities. The $1.4B Bybit hack exposed a systemic flaw in public blockchains: irreversibility. In contrast, Ohanae’s identity-bound wallets, lack of DEX access, and Force Transfer feature make recovery possible and theft structurally impossible. Ohanae's regulated, trust-based model sets a new standard for security in tokenized capital markets.

Introduction

The recent Bybit breach—one of the largest crypto hacks in history—saw an astonishing $1.4 billion drained from the exchange, with more than $380 million already "gone dark" through anonymizing tools and decentralized laundering channels. For many in the crypto world, this serves as yet another sobering reminder of the structural vulnerabilities in public blockchain ecosystems. But for us at Ohanae, it's a sharp contrast to a security-first approach that's already redefining the boundaries of blockchain safety and trust.

The Anatomy of a Modern Crypto Heist

According to CoinDesk, the attackers exploited a front-end vulnerability in Bybit’s Safe Wallet interface. By manipulating JavaScript code, they spoofed what appeared to be a legitimate multi-signature transaction. Even with multiple executive approvals—including CEO Ben Zhou—the transaction rerouted funds directly into wallets controlled by the attackers.

From there, the strategy was textbook laundering:

- Conversion to ETH: Stolen funds were swapped into censorship-resistant ETH using DEXs.

- Distribution: The ETH was divided into approximately 50 wallets, each holding ~10,000 ETH.

- Obfuscation: The funds were funneled through cross-chain bridges and mixers like Tornado Cash, eventually vanishing into peer-to-peer (P2P) and over-the-counter (OTC) ecosystems.

Once these steps were complete, the funds were untraceable. For Bybit, and its users, there was no technical means to claw them back.

Why This Keeps Happening: Public Blockchains Aren't Built for Recovery

There's a common refrain in the blockchain space: "code is law." But when the code is exploited, lawlessness takes over.

The real issue isn't just the hack—it's the absence of recourse. Public blockchains were designed with decentralization and censorship-resistance in mind. These traits are great for philosophical purity and borderless access, but they introduce critical blind spots when it comes to security, compliance, and investor protection.

In other words: once it's gone, it's gone. No phone number. No rollback. No help desk. Just a lesson learned at the cost of millions—or billions.

What If This Happened on Ohanae blockchain?

Let's imagine a parallel scenario using Ohanae's platform:

Andrew initiates a high-value transfer of Ohanae Coins (OUSD, a covered stablecoin) from his Vault. Hackers intercept the UI, spoof a transaction, and route the tokens to a rogue wallet. Tom and Jerry, acting as co-signers, approve the transfer, unaware of the malicious code.

The tokens are stolen.

Now, here's where the story diverges dramatically.

Unlike public blockchains, Ohanae's architecture includes identity, oversight, and control by design. Here's how we'd stop the damage—or even reverse it:

In short, Ohanae makes this kind of theft structurally impossible.

Even if a breach were to occur, every wallet is linked to a verified identity, every transaction is auditable, and Force Transfer allows stolen tokens to be reissued to their rightful owner with regulatory oversight.

No mixers. No bridges. No hiding.

A Philosophical Shift: From "Trustless" to "Trusted"

Blockchain's early promise was to eliminate the need for trust. But what we've seen—especially in capital markets—is that trust doesn't go away. It just shifts.

In Bybit's case, users trusted that their funds would be safe. In reality, the platform lacked the architecture to honor that trust under attack.

Ohanae doesn't ignore trust—it formalizes it. With KYC/AML baked into every wallet, centralized control over smart contracts, and regulatory compliance across every layer, we're building a blockchain where trust and control coexist.

This isn't a compromise—it's a requirement for institutional use cases like:

- Tokenized equity offerings

- Enterprise-grade covered stablecoins

- Regulated asset marketplaces

- Investor protection frameworks

Constraints as a Feature, Not a Bug

Ohanae's model may not appeal to every crypto purist. We don't support anonymous wallets. We don't allow external smart contracts. We don't enable DEX trading or cross-chain escapism.

But these "constraints" are exactly why our system works.

As our engineering team put it: "We're not more advanced than other chains—we're just more disciplined."

By imposing structural boundaries, we eliminate the most common attack vectors. That's not less freedom; it's more responsible freedom.

Key Takeaway

The Bybit hack isn't just a headline—it's a harbinger.

Public blockchain systems, as they're currently architected, are not prepared for the scale and stakes of modern digital finance. And no matter how much is spent on audits or monitoring, a trustless system without recovery mechanisms will always be vulnerable to irreversible failure.

Ohanae offers a fundamentally different path: a permissioned, identity-first, regulator-aligned blockchain built for safety, compliance, and long-term trust.

In a space often defined by volatility, Ohanae is staking a claim for the future: not just decentralized—but dependable.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to digital asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.