Commercial bank money holds the key to a potentially safer tokenized economy

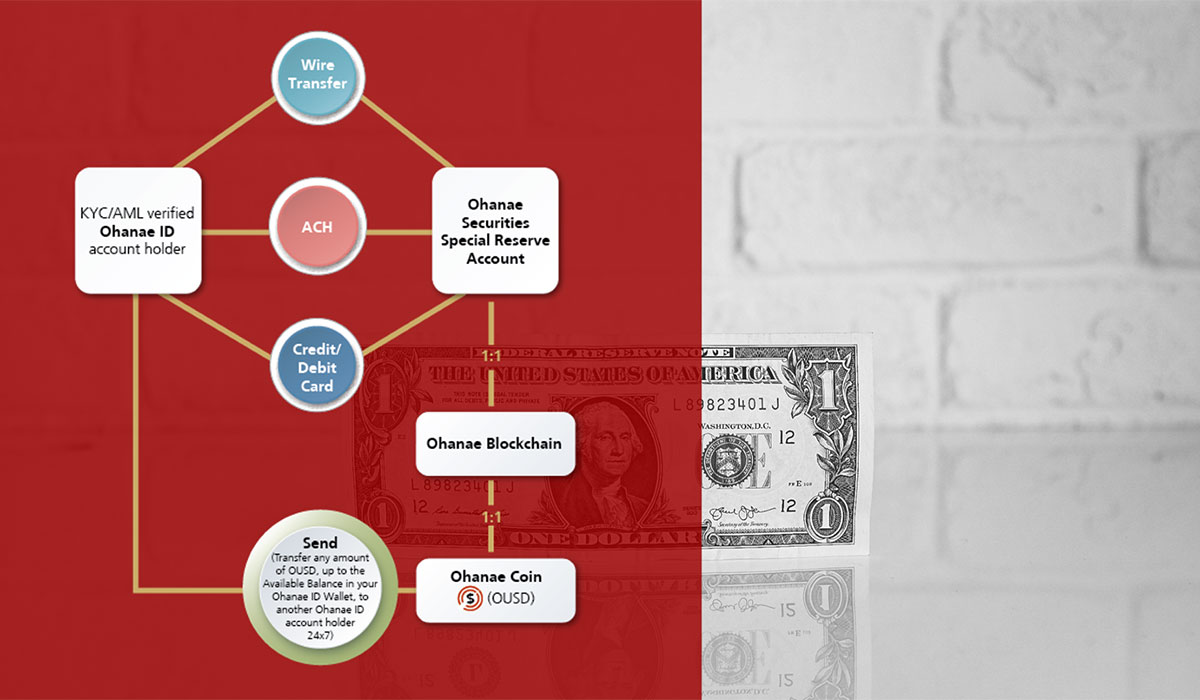

Ohanae Coins ("OUSD") or deposit tokens are tokens issued on the Ohanae Blockchain by Ohanae Securities that represent a deposit claim in approved banks. Since deposit coins can be viewed as a new form of commercial bank money, they may be integrated into the Special Reserve Account for the Exclusive Benefit of Customers ("Special Reserve Account") offered by approved bank.

Ohanae Coins are economic equivalents of existing deposits recorded in a novel form used to pay, settle trades for digital asset securities (equity tokens), and generally considered to act as a store of value and means of exchange on the Ohanae OTC Market Platform ("Ohanae Platform").

Applying Web3 technology in this manner allows payments made with commercial bank money to benefit from programmability, instant and atomic transaction settlement*, and improved transparency as to the status of the transaction. These features help to address common pain points in liquidity management.

It is interesting to see the development of OUSD which is designed to be a stable deposit coin for capital markets. The concept of tokenized commercial bank money could potentially provide a more efficient and programmable way to handle payments and settlement within blockchain-native environments.

The idea that on-chain tokenized bank deposits would be economically and legally equivalent to traditional off-chain deposits is intriguing. It could enable peer-to-peer settlement between KYC-verified users on the Ohanae Platform, potentially providing a more secure and streamlined method of conducting transactions 24x7.

It is also worth noting the Special Reserve Account policies meant to reduce the risk of criminal activities, such as money laundering, that could be facilitated by banks in this context.

- Deposit insurance schemes are mechanisms that protect depositors' money in the event of a bank failure. This type of policy can be beneficial because it gives people confidence that their deposits are safe and can be retrieved even if the bank goes bankrupt or defaults on its obligations.

- Deposit insurance schemes are typically funded by levying a fee on banks based on the level of their deposits, and this fee is then used to build a reserve fund that can be used to pay out depositors if a bank fails. By providing this kind of protection, deposit insurance schemes can help to prevent bank runs and financial crises.

- Banks can be vulnerable to criminal activities such as money laundering due to the large volumes of cash flowing through their systems. To combat this risk, governments and financial regulators have put in place a variety of policies and procedures to reduce the risk of money laundering and other illegal activities in the banking sector.

- Some of these policies include Know Your Customer ("KYC") requirements, which require Ohanae Securities to verify the identities of their customers and assess the risks associated with their transactions. Other policies include anti-money laundering ("AML") regulations that require Ohanae Securities to report suspicious transactions and to have systems in place to detect and prevent money laundering.

- Overall, these policies and deposit insurance schemes can help to mitigate the risks associated with banking and protect both depositors and the financial system as a whole.

It will be interesting to see how the adoption of tokenized commercial bank deposits and the use of OUSD could potentially transform capital markets and enable new forms of programmable money within the Ohanae Platform.

*Atomic settlement: Simultaneous settlement of assets, whereby assets are linked to ensure the transfer of an asset only occurs if the others are simultaneously transferred (e.g., to achieve delivery versus payment in a securities transaction).

Special Reserve Account

Special Reserve Account for the Exclusive Benefit of Customers ("Special Reserve Account") is a specific type of account mandated by financial regulatory authorities, such as the Securities and Exchange Commission ("SEC") or the Financial Industry Regulatory Authority ("FINRA"), for broker-dealers. This account is established to hold customer funds and securities separately from the broker-dealer's own assets, ensuring that customer assets are protected and available for withdrawal or transfer as needed.

The key features of the Special Reserve Account include:

Segregation of Customer Assets: Customer funds and securities held by the broker-dealer are kept separate from the firm's proprietary assets, reducing the risk of commingling or misappropriation.

Exclusive Benefit of Customers: The funds held in the Special Reserve Account are reserved exclusively for the benefit of customers, meaning they cannot be used for the broker-dealer's own purposes or obligations.

Regulatory Compliance: Broker-dealers are required to establish and maintain the Special Reserve Account in compliance with regulatory requirements, such as SEC Rule 15c3-3, which governs the handling of customer funds and securities.

Overall, the Special Reserve Account is designed to protect customer assets and ensure their availability in the event of the broker-dealer's insolvency or other financial difficulties. It plays a crucial role in maintaining investor confidence and protecting the integrity of the financial markets.

Ohanae Coin Rollout

- Ohanae Securities will establish bridge accounts at approved banks in multiple $250K bank deposit tranches.

- Ohanae Securities will mint 250K OUSD for each $250K bank deposit at a bank.

- OUSD will be stored under the treasury account on the Ohanae Blockchain.

- KYC-verified Ohanae Digital Asset Securities Account users may "Add Funds" to the Special Reserve Account via credit/debit card or wire transfer.

- Add Funds via Credit Card ‒ Upon PayPal confirmation of a transaction, Ohanae Platform will send the dollar equivalent in OUSD to the user using the deposits from the Bridge Account. PayPal as the credit card payment processor will auto-transfer the "Add Funds" balance to the Special Reserve Account every night. The money shows up in the Special Reserve Account in 3-5 business days.

- Add Funds via Wire Transfer ‒ Upon receipt of funds, Ohanae Securities will send the dollar equivalent in OUSD to the user.

- OUSD is designed to act as a deposit coin or tokenized representation of U.S. dollars that is pegged 1-1 to the US dollar.

- User deposits shall remain in the Special Reserve Account.

Special Reserve Account balance + Bridge Account balance in multiple banks ≥ Total OUSD minted on the Ohanae Blockchain

Conclusion

With the expansion of digital transactions in terms of scale and intricacy, Ohanae Coins ("OUSD"), also known as deposit coins, can offer a robust basis for digital money and play a crucial role in a wider digital asset securities ecosystem. Their technical characteristics, compliance with established banking regulatory frameworks, and seamless integration with financial services through the banking sector, position OUSD as a stabilizing factor within the capital markets, bringing forth a new era of enhancement for commercial bank money, the most commonly used form of currency globally.

"I believe the next generation for markets, the next generation for securities, will be the tokenization of securities." ― BlackRock CEO, 2022

The statement that "the next generation for markets, the next generation for securities, will be the tokenization of securities" is a widely held belief among many experts in the blockchain and fintech industries.

The tokenization of securities refers to the process of converting traditional securities, such as stocks, and other financial instruments, into equity tokens that can be traded and exchanged on the Ohanae Platform. This has the potential to make securities trading faster, cheaper, and more accessible to a wider range of investors. Tokenization can also enable new forms of liquidity, fractional ownership, and programmability, which could transform the way securities are issued and traded. For example, it could allow for the creation of new investment vehicles, such as equity tokens that represent ownership in a particular asset, like real estate. Overall, the potential benefits of tokenization for securities markets may be significant, and it is likely that we will see increased adoption of this technology in the coming years.

However, there are also challenges and risks associated with tokenization, such as regulatory compliance, security, and liquidity concerns, that need to be addressed for it to become a mainstream solution.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer’s expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to digital asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. Ohanae Securities will limit its business to digital asset securities to isolate risk and having policies and procedures to, among other things, assess a given digital asset security’s distributed ledger technology and protect the private keys necessary to transfer the digital asset security.