Abstract

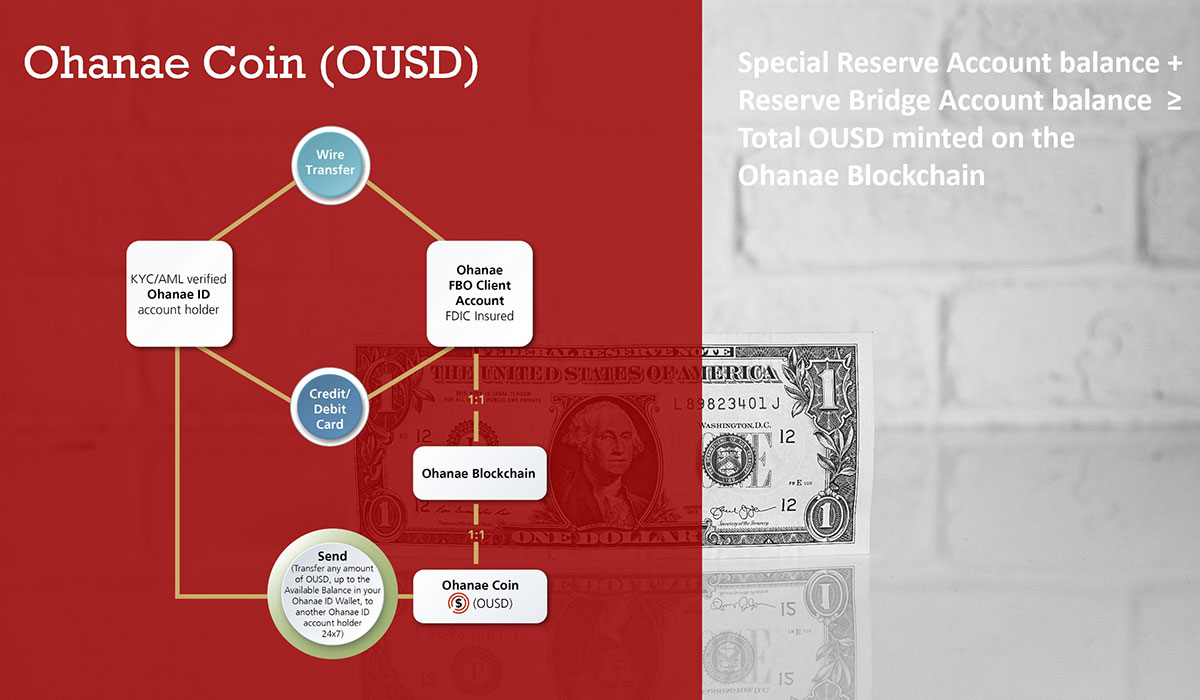

Ohanae Coin (OUSD) is a USD-pegged, yield-retaining tokenized cash instrument issued by Ohanae Securities LLC, a wholly owned subsidiary of Ohanae, Inc., on the Ohanae blockchain. Designed for compliant settlement of equity tokens in a non-Reg NMS OTC Market, OUSD is backed 1:1 by U.S. dollars held in a Special Reserve Account (SRA) for the Exclusive Benefit of Customers. It is programmable, KYC-restricted, and retains any yield to enhance reserve strength—eliminating any expectation of profit for holders.

OUSD underpins Ohanae's Equity Token Offering (ETO) and Hybrid Automated Market-Making (AMM) Settlement Model, where Ohanae Securities acts as principal dealer, executing trades against its own account. Other broker-dealers may serve as passive liquidity providers without interacting with a central order book. OUSD serves as a regulated, blockchain-native settlement instrument purpose-built for tokenized capital markets.

Commercial Bank Money, Reimagined for Secure Digital Settlement

Ohanae Coin ("OUSD"), commercially branded as a Deposit Coin for Payment, is a tokenized representation of U.S. dollars held in regulated custody. Issued exclusively by Ohanae Securities LLC on the Ohanae blockchain, OUSD facilitates secure and compliant settlement of equity token transactions and other crypto asset securities in a closed-loop environment.

OUSD is not a public stablecoin nor a deposit-taking instrument. It is a private, permissioned payment token governed by U.S. securities law, and intended solely for use on the Ohanae platform by verified customers. The token is backed 1:1 by USD reserves maintained in segregated Special Reserve Accounts (SRAs) under the custody of regulated banking institutions and trust partners.

Key Features and Use Cases of OUSD

- Settlement Instrument: Enables instant, atomic delivery-versus-payment (DVP) settlement of equity tokens within Ohanae’s infrastructure.

- Programmability: Supports smart contracts, Web3-native compliance logic, and auditable transaction flows.

- KYC-Restricted Access: Available only to users with verified Ohanae ID, aligning with BSA/AML and anti-illicit finance requirements.

- 1:1 Reserve-Backed Stability: OUSD’s total supply is backed by real USD held in diversified SRA accounts, following the formula:

OUSD Reserve Formula: Special Reserve Account balance + Reserve Bridge Account balance ≥ Total OUSD in circulation

- No Yield Distribution: Any yield from reserve deposits is retained in the SRA to strengthen coverage. OUSD holders do not receive yield, eliminating any expectation of profit.

- Fee-Free Transfers: Internal transfers incur no wire or ACH fees; withdrawal fees may be absorbed by Ohanae Securities.

The Special Reserve Account (SRA): Foundation of Trust

The Special Reserve Account ensures customer protection and reserve integrity in accordance with SEC Rule 15c3-3. Core protections include:

- Segregation of Customer Funds: OUSD reserves are never co-mingled with proprietary funds of Ohanae Securities.

- Diversification and FDIC Coverage: USD deposits are distributed across FDIC-insured banks in $250,000 tranches to maximize deposit insurance coverage.

- Third-Party Attestations: Subject to periodic audits and attestations for transparency.

- Real-Time Reserve Monitoring: Automated reconciliation processes ensure continuous compliance with the OUSD Reserve Formula.

OUSD is minted only when a user funds their account via card or wire and is burned upon withdrawal requests. The bridge accounts act as controlled entry/exit points, with funds routed into or out of the SRA under strict compliance logic.

Regulatory Positioning

In alignment with the SEC's April 4, 2025 Stablecoin Statement, OUSD is classified as a crypto asset—not a money market fund share or insured deposit. It is issued and custodied by a pending Special Purpose Broker-Dealer (SPBD), Ohanae Securities LLC, and does not operate on public blockchains. This closed-loop, KYC-controlled environment distinguishes OUSD from public stablecoins.

Importantly, OUSD is not marketed or structured as an investment contract, and holders have no expectation of profits. All reserve yield is retained to bolster liquidity backing. These features align OUSD with the intended scope of regulated, non-speculative payment instruments in the SEC and GENIUS Act framework.

Hybrid AMM Settlement Model: Principal Dealer Execution

OUSD is integral to Ohanae's proprietary market infrastructure:

- Principal Dealer Role: Ohanae Securities executes trades as principal, quoting and settling equity token and OUSD pairs.

- No Central Order Book: The AMM model avoids centralized matching or quote dissemination, reducing regulatory complexity under ATS rules.

- Passive Liquidity Providers: Broker-dealers may contribute capital to liquidity pools passively—without discretionary trading or order routing.

- Reg NMS Exclusion: The market operates as a non-Reg NMS OTC system, relying on SPBD-compliant practices for alternative market structure innovation.

This model allows regulated trading of crypto asset securities while leveraging smart contract-based AMM mechanics to ensure continuous liquidity and transparent pricing.

Conclusion

Ohanae Coin (OUSD) exemplifies the next evolution in blockchain-based settlement infrastructure—bridging regulated finance with Web3-native architecture.

By merging 1:1 reserve backing, non-speculative structure, KYC-only access, and integration into an SPBD-compliant market model, OUSD offers a legally robust alternative to both public stablecoins and legacy payment rails.

As the foundation of Ohanae’s Hybrid AMM Settlement Model, OUSD represents a regulated path forward for tokenized capital markets—purpose-built for a compliant and efficient digital future.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to crypto asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.